Predictions are tricky. They are statements about what you “think” will happen in the future. When there are a lot of experts doing the “thinking,” you may end up with a wide range of predictions – especially when there are so many fluctuating factors. That pretty much sums up the housing market forecast for 2023, which ended up being somewhat unpredictable.

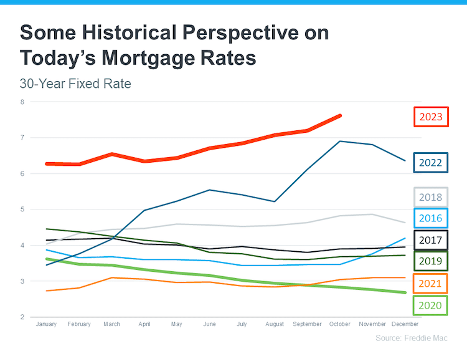

Last year, experts predicted that home sales would stabilize, and prices would moderate after the pandemic frenzy. In reality, prices hit a record high in 2023, rising 7% from the beginning of the year. And the hopeful projections that mortgage rates would decline steadily never came to pass. In fact, mortgage rates climbed to their highest level since 2000. Some real estate experts called 2023’s mortgage rates a “wild ride,” with highs reaching 8.45% and lows hitting 6.11% for a 30-year fixed mortgage.1 The year ended with mortgage rates hovering around 7%.

In summary, high mortgage rates and lack of inventory negatively impacted affordability in 2023. It was hailed as the “least affordable housing market in a generation.”

So, what does the new year bring for home buyers and sellers?

Well, the good news is that no one expects conditions to get worse. In fact, many experts believe the new year will be a turning point for real estate with lower mortgage rates, more sellers, and a slight decrease in prices, all of which should result in increased home sales in 2024.

“For home buyers who are taking on a mortgage to purchase a home and have been wary of the fluctuations and autumn rise in mortgage rates, the market is becoming more favorable, and there should be optimism entering 2024 for a better market,” said Jessica Lautz, deputy chief economist at the National Association of Realtors (NAR).

Let’s take a closer look at the forecast.

MORTGAGE RATE TRENDS

Inflation has decreased from its high of 9.2% in June 2022 to its current rate of 3.1% which means the Federal Reserve plans to reduce interest rates in 2024. More specifically, it’s predicted to be reduced two to four times this year with a median rate cut of 0.25%. This is important because mortgage rates follow this movement. Most experts agree that the downward trend in mortgage rates that began at the end of 2023 will continue this year. But don’t expect dramatic drops into the 3-4% range.

As with most predictions, the numbers cover a wide range. At the high end, Zillow expects rates to stay between 7% and 7.5%. Meanwhile, NAR expects rates to average below 7% by spring and end the year around 6.3%. Realtor.com is the most optimistic, projecting mortgage rates averaging 6.61% and trending lower by December 2024.

“Mortgage rates will continue to ease in 2024 as inflation improves and the Fed rate cuts get closer,” said Danielle Hale, chief economist at Realtor.com. “Mortgage rates could near 6.5% by the end of the year, a key factor in starting to provide affordability relief to home buyers.”

What this mean for buyers and sellers: Lower mortgage rates improve affordability, so you can buy “more house for your money.” If you’re not in a hurry, you may want to wait for rates to decline later in the year or even into 2025.

If you’re selling, higher rates mean there will be fewer buyers, so be prepared to wait a little longer for offers to roll in. As rates decline, the number of buyers should increase. Of course, if you currently have a low mortgage rate and you don’t need to sell, you may want to wait until rates improve.

HOME INVENTORY TRENDS

As mortgage rates decline, there should be increased activity in the housing market as more people list their homes for sale. Sellers who had low mortgage rates and were reluctant to give them up, may jump back into the market.

“Supply will loosen up in 2024. Even homeowners who have been characterized as being ‘locked in’ to low rates will increasingly find that changing family and financial circumstances will lead to more moves and more new listings over the course of the year, particularly as rates move closer to 6.5%,” predicts Lisa Sturvevant, chief economist at Bright MLS.

What this mean for buyers and sellers: If more people list their homes for sale, competition will decrease, causing prices to remain steady or decline slightly, depending on the area. Buyers will also have more choices, but you will still need to move quickly because inventory remains low.

If you’re selling a home, low inventory means less competition. So, if your home is in a great location and has features that buyers want, you can expect to receive multiple offers, but not as many as the past two years. As inventory increases, this competition will cool off, potentially reducing the number of offers, as well as the price buyers are willing to pay.

HOME PRICE TRENDS

NAR reported that home prices continued to rise in the second quarter of 2023. In fact, there were record-high increases in 53.9% of 221 metro areas last year! The median home sales price in the U.S. was $431,000, which was 4% higher than the previous year.

While most experts agree that home prices will cool off in 2024, some project prices to stay flat and others expect a modest increase due to pent-up demand and low inventory. According to the Fannie Mae Home Price Expectations Survey (HPES), we can expect home price growth of 2.4% in 2024 and 2.7% in 2025. Compared to the past few years, this is good news for home buyers.

According to NAR: “Buyers are still competing for fewer available homes, keeping upward pressure on home prices. On a national level, prices aren’t going to plummet unless we get a sudden, large influx of listings. That doesn’t mean there won’t be some markets where home prices decline.”

What this mean for buyers and sellers: Overall, don’t expect home prices to drop, but if inventory increases you might see prices remain flat or decrease slightly in some markets. Affordability will still be an issue, but the combination of improving mortgage rates and steady home prices will give buyers a slight advantage. If you’re house hunting, it’s important to know exactly how much house you can afford and commit to stay within that budget.

If you’re selling a house, you probably won’t see as many offers as we saw during the height of the buying frenzy or offers above the listing price, but you can still expect a nice profit. However, you’ll need that extra cash when buying your next home. With inventory still low, it’s a good idea to know where you’re moving to before selling.

LOCAL TRENDS

In November 2023, there were 30,519 homes for sale in Michigan, down 9.61% year over year, but the number of newly listed homes was up 2.0%, signaling an increase in sellers. According to Redfin, 32% of homes in Michigan sold above list price last year due to the low inventory. As a result, home prices in Michigan were up by 10.7% in September 2023! Overall, home prices in Michigan were up 5.4% in 2023 to a median price of $251,600.

There continues to be more demand than inventory here in Michigan, pushing prices upward. However, prices vary widely across the state. Areas with the highest year-over-year increases in sales prices, as reported by local Realtor associations, include the following:2

- Isabella County (Central Michigan/Mt. Pleasant) – 29.91%

- Manistee County – 24.91%

- Grosse Pointe – 20.64%

- Battle Creek – 20.56%

- Clair County – 17.88%

Meanwhile, properties in Huron County (along Lake Huron) saw the largest drop in prices year-over-year – down 27.91%. Other areas that reported significant price declines included:

- Detroit – 15.9%

- Emmet County – 12.2%

- Bay County – 6%

- Joseph County – 5.19%

What’s the hottest market in Michigan? According to Realtor.com, the Grand Rapids-Kentwood market ranked 9th in the nation with a projected increase in home sales of 6.1%.

Here’s a quick overview of Southeast Michigan data (year-over-year), courtesy of Houzeo:

- Average home prices: The average median home price is $251,600, up by 5.4%. Experts predict the median sale price will increase slightly due to the tight inventory. Currently, the sale-to-price ratio is at 99.4% and is expected to remain steady.

- Home sales: Home sales decreased last year by 19%, primarily attributed to high mortgage rates.

- Median days on the market: The median days on the market for homes for sales was 22 days, down by 4 days year-over-year.

- Pending sales: The number of homes for sale in 2023 dropped by 16.2% compared to 2022.

What can Michiganders expect in 2024?

- Home sellers will return to the market in 2024: Sellers who chose to postpone listing their homes in 2023 will reconsider this year, especially those who can’t avoid new jobs or want to downsize and reduce costs.

- Mortgage rates will stabilize and then decrease in the second half of the year: Look for rates to hover around 7% in the first half of the year, and then decrease to 6.3% by year end.

- Buyer demand will increase: Easing inflation and steady-to-lower mortgage rates will lure buyers back into the market.

- Home prices will continue to rise: Home prices rose steadily in the top metro areas in Michigan year-over-year, and experts predict home prices will continue to rise until the low supply changes.

- New home construction sales will increase: In September 2023, 12.3% of homes purchased in Michigan were new construction, the highest since 2022. Home builders offered an average of $30,000 in concessions to attract buyers in 2024, a trend that should continue this year.

In Conclusion

There is a phenomenon called the “rate lock-in effect”, which occurs when homeowners stay locked-in to low mortgage rates instead of selling their homes and buying another at higher rates. That’s exactly what occurred in 2023, which brought the housing market to a standstill. It’s estimated that 85% of mortgage holders are locked-in to pandemic-era rates below 5% and are staying put. But there are signs of improvement.

Mortgage rates have declined and are predicted to remain steady, with a chance of further drops in the second half of the year. This should boost existing home sales and encourage potential sellers to list their homes. However, don’t expect the number of homes for sale to increase much.

“We don’t expect to see an end to the shortage of homes for sale,” says Danielle Hale, chief economist for Realtor.com. “Despite this, households will have more options in 2024 from a small uptick in single-family home construction, and the completion of the large number of multi-family units that are under construction, the vast majority of which are destined to be rental homes.”

To sum things up: “The pandemic was too hot; 2023 was too cold,” says Odeta Kushi, deputy chief economist at First American Financial Corporation. “2024 won’t be just right, but it will be heading in a normalizing direction.”

At this point, normal sounds good.

Trying to decide if this is a good time to buy a new home or sell your existing home? Let us help you make sense of the housing market…

Other Sources:

https://www.forbes.com/advisor/mortgages/real-estate/michigan-housing-market/

https://www.forbes.com/advisor/mortgages/mortgage-interest-rates-forecast/

https://www.houzeo.com/blog/michigan-real-estate-market/

https://www.ramseysolutions.com/real-estate/real-estate-trends