“Volatile,” “uncertain,” and “crazy,” were common words used to describe the housing market in 2022. If last year was a virtual rollercoaster ride of pricing and inventory, 2023 should be more like a merry-go-round – a lot less jarring and more predictable! In fact, economists are predicting that normalcy will return to the market in 2023. But, what exactly does that mean?

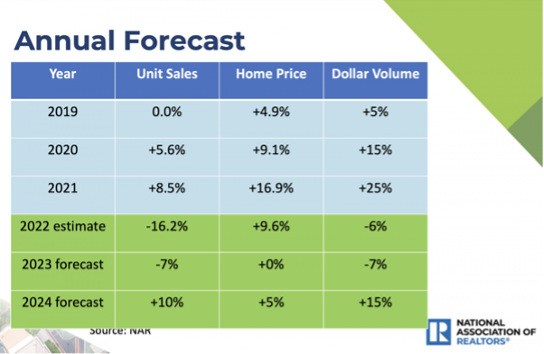

At the National Association of REALTORS® annual Real Estate Forecast Summit in December, experts said home sales are expected to stabilize and prices moderate after recent highs. Although the details could differ from one region to another, the overall market should adjust to pre-pandemic levels.

“There was a homebuying frenzy during the pandemic,” said Lawrence Yun, NAR Chief Economist. “But rapidly rising mortgage rates and inflation put the brakes on that activity last year. Some housing markets may see an uptick in homebuying activity at the beginning of 2023, especially if mortgage rates continue to decline from a recent high of 7%. Overall, I see many hopeful signs for 2023.”

Yun explained that housing inventory is expected to remain tight in 2023, with new housing starts below historical averages and fewer homeowners willing to sell. These ongoing housing supply challenges will prevent home prices from falling, though price appreciation will slow.

Home sales are expected to fall by approximately 7% in 2023 compared to last year, with most of the slowdown occurring in the first quarter. The reason for this is two-fold: Economic uncertainty coupled with homeowners who are unwilling to give up locked-in lower interest rates. What does that mean for home prices? It depends on who you ask. Some experts believe prices will stay level, while others predict a slight decline in prices over the next 12 to 18 months, before they stabilize and then recover, and still others project a slight increase. Much of this depends on whether supply can keep up with demand, and which market you’re in.

“After a big boom over the past two years, there will essentially be no change nationally in home prices in 2023,” said Yun. “Half the country may experience small price gains, while the other half may see slight price declines.”

Mortgage Rate Trends

Mortgage rates seem to have peaked at 7.8% in November and are beginning to decline. NAR believes mortgage rates will settle at 5.7% by the end of 2023. If inflation continues to slow, as projected, and mortgage rates stabilize, more people will be tempted to buy homes, which could boost demand.

Of course, NAR is not the only experts weighing in. Realtor.com’s Chief Economist Danielle Hale was a bit more bullish on home prices. She projects a 5.4% increase in existing home prices in 2023. “We think price growth will be half of what it was in 2022, and we may see some months of year-to-year declines,” predicted Hale. “But overall, we believe prices will be higher. Housing shortage conditions are still going to be present.” In other words, home buyers will continue to struggle with affordability, especially in “hot” markets.

Trends to Watch

While forecasts differ slightly among real estate experts and economists, there are some trends that most industry pros agree on, including:

- Slowly growing inventory – The real estate market has been dealing with low inventory since 2020. There haven’t been enough homes for sale to meet buyer demand, driving prices up, but this trend may be starting to change. In November, the market saw a 46% increase in homes for sale year-over-year. This is still lower than previous years, but it may signal an increase in available houses on the market. Overall, the housing inventory is expected to remain tight in 2023, which will prevent home prices from falling.

What does this mean for buyers and sellers? If you’re looking to buy a home, you’ll still need to move quickly, as the best houses will be snatched up fast – but not at the lightning speeds we saw last year.

If you’re selling a home, low inventory means less competition. So, if your home is in a great location and has features that buyers want, you can still expect to receive multiple offers – but not as many as there were in 2022.

- Higher mortgage rates – Experts believe interest rates will peak this year and then slowly start to go down again. The average rate for a 15-year fixed rate mortgage jumped from 2.8% in January of 2022 to 6.36% in October, while the average rate for a 30-year fixed rate mortgage rose to 7.08%. This is a far cry from the historical low of 2.65% in January of 2021! Until rates recede, there will be less buyers in the market because home buyers can’t afford as much house. Normally, a hike in interest rates causes demand to decline and home prices to drop, but because inventory is still low, experts expect prices to remain steady or fall only slightly in 2023. It will still be an expensive market and “affordability” may become more desirable than the ever-popular open floor plan!

What does this mean for buyers and sellers? Higher rates impact affordability, so if you’re not in a hurry to buy a house, you might want to wait until rates decline.

If you’re selling, higher rates mean there will be fewer buyers, so be prepared to wait a little longer for offers to roll in.

- Home values will continue to rise, but at a slower rate – The national median home price increased by 11% in 2022 to $416,000 compared to 2021. However, home price growth is slowing down and though some experts predict that prices will still rise slightly, they will begin to settle down as the year progresses. It appears that the home-buying frenzy is fizzling out.

What does this mean for buyers and sellers? “After several years of a ‘sellers’ market, 2023 could feel more like a nobody’s market,” commented Hale. While an increase in inventory could give buyers a slight advantage, affordability will still be an issue. If you’re house hunting, it’s important to know exactly how much house you can really afford and commit to stay within that budget. It can be frustrating to find the right home within your budget, but it beats getting stuck with a mortgage payment you can’t afford!

If you’re selling your home, you can still expect a nice profit, which is great because you’ll need that extra cash when buying your next home. It’s also good idea to know where you’re moving to before selling!

- New construction will slow down – The National Association of Home Builders expects new home construction to decline by double digits in 2023. Rising mortgage rates and economic uncertainty are causing builder confidence to slump. Builders are also dealing with labor shortages and higher material costs. Some new home and multi-family construction are already being put on hold until interest rates decline. As a result, 59% of builders report using incentives like mortgage rate buydowns and price cuts to woo buyers. However, they expect the economy to improve in 2024 and new construction to gradually increase.

What does this mean for buyers? Considering these incentives, now may be a good time to consider newly built homes.

What to Expect Locally

Since inventory and prices can vary dramatically by market, national real estate figures never tell the complete story. Where a local economy is strong, we tend to see more robust price increases. In contrast, higher-priced markets, where affordability is a challenge, may experience more significant price drops.

Here in Southeast Michigan (Livingston, Macomb, Oakland and Wayne counties combined), the median house price in December 2022 decreased 2.6% over last December, and listings were on the market an average of 34 days, up 6 days compared to last December. In contrast, the median sale price in Lapeer County, increased to $255,000, up 1.5% over last December. Houses in this area did stay on the market 9 days longer than last year December, with an average of 46 days. Median home prices in Macomb county also increased slightly (0.3%) over last December to $215,000, and stayed on the market 6 days longer on average year over year to 32 days.1

Here’s a quick overview of Southeast Michigan data (December 2022 vs. December 2023), courtesy of Realcomp:

- Closed sales were down by 12.4% from 132,990 to 116,488.

- Pending sales were down by 13.0% from 131,864 to 114,699.

- The median sale price increased 6.7% from $225,000 to $240,000.

- The average percent of the list price received decreased .3% from 100.7% to 100.4%.

- New listings decreased by 5.3% from 155,789 to 147,548.

- Average days on market decreased by 2 days from 29 to 27 days.

Of course, these numbers represent a high-level overview of real estate trends in Southeast Michigan. As you can see by the data from individual counties, the numbers can differ significantly.

In Conclusion

“The frenzied pace of home sales activity during the pandemic was not typical or sustainable, nor is it good for a healthy market,” said Lisa Sturvent, chief economist for Bright MLS. “A return to a slower market with more modest growth is a good place to be headed into 2023.”

The most important thing to keep in mind when buying or selling a home is that despite expert projections, the market can be unpredictable. It can quickly change due to economic, political, or geo-political events. Therefore, the key to success is finding a trusted real estate and mortgage advisor that can provide the best advice and support along the way.

Sources:

https://www.ramseysolutions.com/real-estate/real-estate-trends